You may have heard there’s an option to totally freeze your credit file from being accessed by anyone who may be looking to do you and your credit file harm by stealing your identity.

Also, you may be asking yourself, “should I freeze my credit?” Would your credit be safer from attacks? Can this help or even hurt your credit or your ability to apply for future credit?

In this post, we’ll cover all the things you’re probably wondering about freezing your credit. But first let’s discuss what freezing your credit actually means.

In the simplest terms, freezing your credit means you are putting a security freeze or a lock on your credit file that prevents prospective creditors from accessing your credit.

Creditors typically won’t offer you credit if they can’t access your credit reporting file, so a security freeze, also called a credit freeze, prevents you or others from opening accounts in your name. Security freezes can be useful in preventing an identity thief from opening a new credit account in your name.

What’s the Difference Between Freezing and Locking My Credit?

So yes, there are two ways to prevent access to you credit file – you can lock it or freeze it. So what’s the difference?

There is little distinction here except that it’s a bit easier to lock and unlock your credit than it is to freeze and unfreeze. However, freezing is not only free with all three credit bureaus but it’s also protected by law, and last for a minimum of 7 seven years.

Locking your credit is now free with Equifax and Experian but comes with a $19 month charge to lock your credit with Trans Union.

In my estimation, it’s better to freeze than to lock your credit.

Does a Credit Freeze Hurt My Credit?

Freezing your credit has no direct impact on your credit score. It certainly will not lower it. Indirectly, freezing your credit can actually help improve your credit score (or at least keep it from dropping), because it prevents unwanted credit lines from being opened in your name.

A credit freeze also does not “freeze” your credit score where it is. Your score will continue to rise and fall depending on how responsible you are with your credit.

Who Can Access Your Credit File When It’s Frozen

Locking or freezing your Equifax credit report will prevent access to it by certain third parties. Locking or freezing your Equifax credit report will not prevent access to your credit report at any other credit bureau. Entities that may still have access to your Equifax credit report include:

- Companies like Equifax Global Consumer Solutions, which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service;

- Companies that provide you with a copy of your credit report or credit score, upon your request;

- Federal, state, and local government agencies and courts in certain circumstances;

- Companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes;

- Companies that have a current account or relationship with you, and collection agencies acting on behalf of those whom you owe;

- Companies that authenticate a consumer’s identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud; and

- Companies that wish to make pre-approved offers of credit or insurance to you. To opt out of such pre-approved offers

A credit freeze restricts access to your credit report, which means you — or others — won’t be able to open a new credit account while the freeze is in place. You can temporarily lift the credit freeze if you need to apply for new credit. When the freeze is in place, you will still be able to do things like apply for a job, rent an apartment, or buy insurance without lifting or removing it.

Federal Trade Commission

How to Freeze Your Credit File

Contact each of the three major credit bureaus — Equifax, Experian and TransUnion — individually to freeze your credit:

- Equifax: Call 800-349-9960 or go online. Check out our step-by-step Equifax credit freeze guide.

- Experian: Call 888‑397‑3742 or go online. Here’s a detailed walk-through on getting an Experian credit freeze.

- TransUnion: Call 888-909-8872 or go online. Read our TransUnion credit freeze guide.

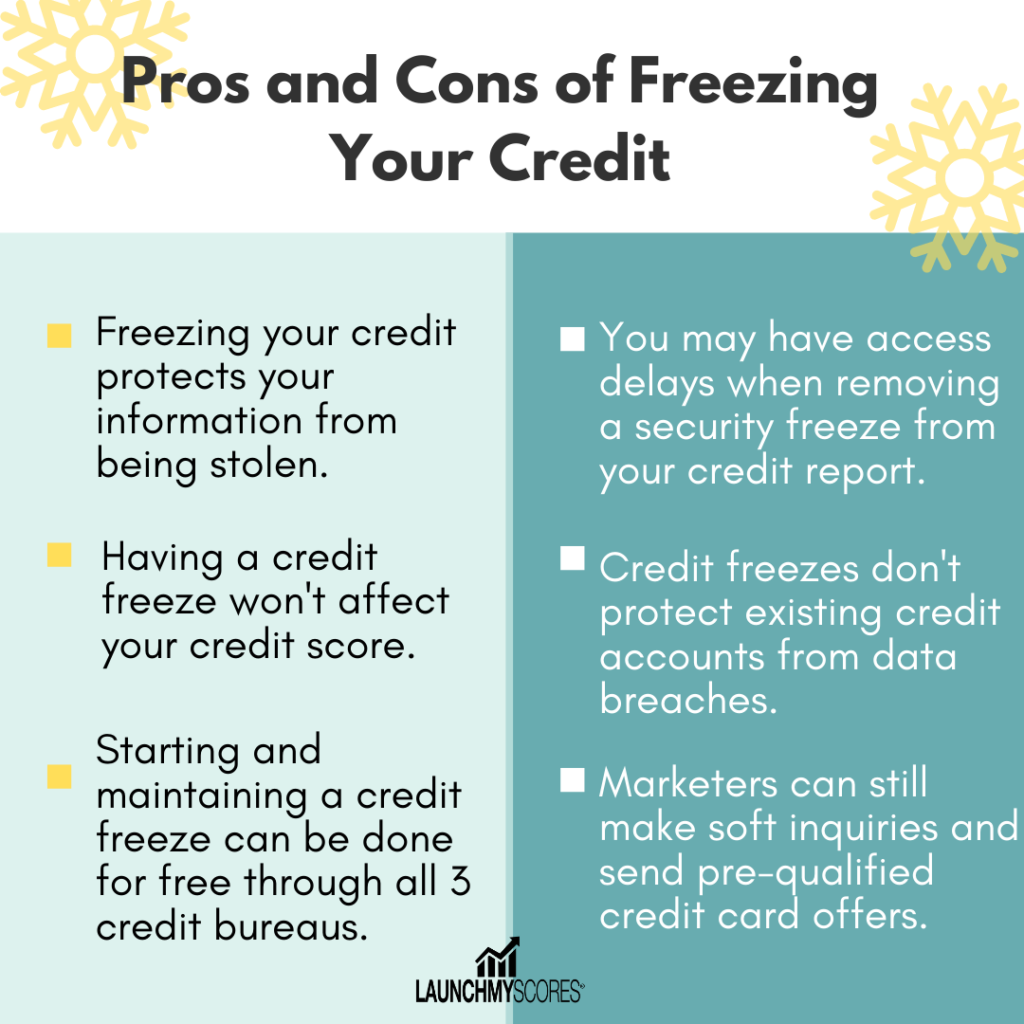

The Pros and Cons of Freezing Your Credit

There are a few pros and cons to freezing your credit file that you should know about.

The Pros:

- Freezing your credit protects your information from being stolen.

- Having a credit freeze won’t affect your credit score.

- Starting and maintaining a credit freeze can be done for free through all 3 credit bureaus.

The Cons:

- You may have access delays when removing a security freeze from your credit report.

- Credit freezes don’t protect existing credit accounts from data breaches.

- Marketers can still make soft inquiries and send pre-qualified credit card offers.

When it comes to freezing your credit, there really isn’t any downside, and it won’t impact your credit score.

Even lifting the freeze when you need to access your credit and freezing it again takes mere minutes. And that’s certainly worth it for the peace of mind of knowing you’re protected from criminals who could ruin your financial life.