You’ve made the best decision to start repairing your credit to shape a better financial future for yourself, but you’re inching to know just how long is it going to take to see excellent credit on your credit report?

The quick answer is that your credit score can be raised 50-100 points or even more in a matter of months by simply having errors removed from your credit report, lowering your credit utilization rate to under 30%, paying off collections, and becoming an authorized user. However, repairing credit is not generally a quick process and can take many months for the credit bureaus to update new information and issue updated scores.

You’ll likely be waiting much longer for excellent credit because this will require the right mixes of credit accounts, a balanced usage (utilization) of those credit accounts, and all incorrect information and collections paid off and removed from your credit report.

Those things naturally take time and you may need added income to be able to pay down credit cards and/or collections. Finding the money to make these payments tends to slow things down for a lot of individuals.

The thing to remember is that taking action, no matter how small, keeps the good credit ball rolling…no matter how slow it may seem. Over time, you will see a lasting difference on your credit score.

So What Makes Up My Credit Score?

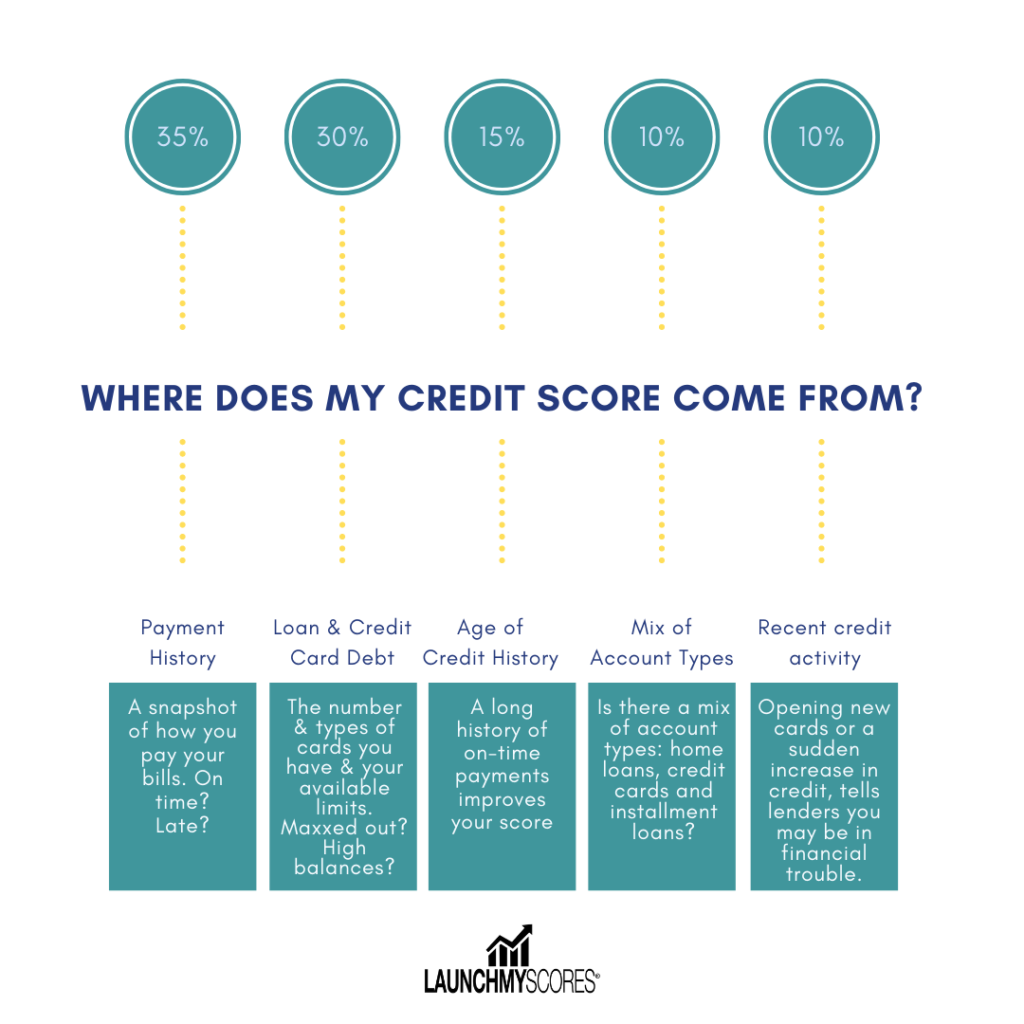

Your overall credit score is made up of 5 factors that as you can see in the graphic below, aren’t weighed equally.

The most heavily weighted credit factor is your payment history. This is a snapshot of how well you pay your bills each month. Are you late? Or are you consistently on time? Making a payment late once and a while may seem like no big deal, but it can cost you a minimum of 50 points on your credit score.

The next most heavily weighted credit factor is your utilization rate. This is all of your loan and credit card debt in relation to how much of your available credit you are actually using. When you’re maxed out on all your available credit, it will wreak havoc on your credit score.

The third credit factor is the age of your credit accounts. If all your accounts are new it is less positive for your credit score than if you had more aged accounts.

The fourth credit factor is the mixture of your credit types. It is more favorable to have a mix of revolving credit like credit cards with installment credit like a car loan or student loans. Having all credit cards isn’t well balanced.

And finally the last credit rating factor is your recent credit activity. This really comes into play, for example, if you’ve applied for new credit while in the mortgage approval process.

What are the Steps to Repairing My Credit?

- Order your credit reports and review them for any errors and collection items that should be paid.

Mistakes happen. In fact, the Federal Trade Commission estimates that one in five consumers has at least one error on their credit report.

These errors can affect your ability to get approved or cause you to pay higher rates when you are approved. The only way to verify that your credit report contains the right information is to review the information on an ongoing basis.

- Pay, settle, or make payments with the collections you accurately owe.

Once you finish paying off the debt your owe, your credit reports will automatically update to reflect the change. However, because creditor billing cycles vary, it may take about 30 days for your reports to actually show the change. If 30 days have passed, and your credit report still hasn’t been updated, contact the credit bureau and send a written notification to the debt collector as well.

Check with your collector to see how a paid-off account will be reported to credit bureaus. To minimize damage to your credit score, you’ll want it reported as “paid in full” so it will be clear the debt wasn’t settled for less than the full amount.

Even if you fully pay off your debt, it’s worth remembering that collection activity is allowed to stay on a credit report for seven years. To ensure your credit history recovers in the end, you’ll need to work at landing in collections again.File dispute letters with the credit bureaus for collection items that are not correct or incomplete to have them removed.

- File dispute letters with all three credit bureaus to have the errors on your credit report removed.

The process of filing dispute letters can take months and a lot more patience. Here’s a detailed tutorial on how to file dispute letters properly and get results faster.

Also it’s important to note that credit bureaus must respond to disputes within 30 days and have to remove erroneous information immediately, so if you report a genuine error, you could see your score change for the better within a month depending on other factors in your credit report.

- Keep your credit healthy by making your monthly payments on time every month and having a nice mix of credit types.

Healthy credit accounts create healthy credit scores. A full 35% of your credit score depends on your payment history, and just one missed or late payment can knock your score down quite a bit.

Credit mix is another factor—in fact, your account mix makes up 10% of your credit score. Why? Because lenders want to know that you can handle both types of credit accounts responsibly.

It’s best to balance installment accounts like car loans and mortgages with revolving credit accounts like credit cards and lines of credit.

- Bring your overall credit utilization rate down to below 30%.

This simply means that your overall available credit is not overextended or “maxed out.” You shouldn’t be using more than 30% of all your available credit. So why can’t you simply use what was make available to you to use?

Simply put, your credit utilization (debt-to-credit ratio) is all about proof of responsibility. When you keep your credit utilization between 10 and 30% of your total available credit, lenders see that you’re a responsible consumer.

- Preserve your most aged credit accounts and keep them in good health.

In the credit world, age matters and the older the better. If you have older, more established revolving credit accounts you should think twice before paying them off or closing them.

Roughly 15% of your credit score depends on your average credit age. If you need to reduce your credit card debt, start with your newest cards first.

What are Things I Should Avoid When Repairing My Credit?

- Making payments on very old debt.

One of the worst things you can do while trying to improve your credit is to make a payment on a “time-barred” debt that falls outside your state statute of limitations. Making a payment can restart that debt, keeping that negative payment history on your credit report for years longer than if you hadn’t made a payment.

Statute of limitation laws on debt vary by state and average three to six years, according to the Federal Trade Commission (FTC).

- Closing out too many credit accounts too fast.

When you’re trying to reduce your overall debt, you may jump into panic mode and want to pay off and close everything out. This can backfire big time so do your research first.

If you have older accounts with higher available credit, do not close these accounts. Established accounts with higher available credit will help your credit score, not hurt it. You simply need to pay down your balance to bring it under 30% utilization.

- Applying for too many new credit accounts.

You may be trying to increase your credit mix by applying for an installment loan, for example. But you should do this with caution. Too many “hard inquiries” from creditors in a short period can lower your credit score so choose wisely.

What Should I Do After I Reach My Credit Goals?

Maintaining good credit habits is extremely important during the credit restoration process as well as after. These habits are lifetime behaviors that will help you build a solid financial future.

An all too common mindset when individuals are repairing their credit is simply to get their credit core high enough to qualify for something like a new car or a mortgage. Unfortunately, this mindset alone can lead to the same choices that got them into the credit trouble in the first place.

A healthier mindset would be to fix your credit so you can start a new season with a good credit rating that you will protect and preserve for many years to come. This way temptation won’t get the best of you when your credit score soars.