We truly live in a microwave society and seem to expect fast and instant results with just about everything. But there’s one area where fast is subjective and instant isn’t real and that’s your credit rating.

You may have seen promises from credit repair agencies to increase your credit score by as much as 100 points overnight. You may have even asked the question, “can I raise my credit score 100 points overnight?”

Especially if you’re a victim of identity theft. This would be really amazing if only it were true.

There’s simply no such thing as a company that can improve your credit overnight, no matter how much you pay them and no matter your unique circumstances.

The FCRA, FDCPA, and FCBA laws allow the credit bureaus and furnishers 30-45 days to complete a dispute, 15 days to complete a method of verification request, and 30 days for debt validation. There’s no legal way to get around these laws. That’s why you’ll never see a legitimate credit repair company advertising anything like that.

Permanent positive results that increase your credit scores take a substantial amount of time and work. If you hear of a credit repair company advertising overnight results or something too good to be true… RUN.

Realistic Ways to Increase Your Credit Score

In order to be effective in raising your credit score, it’s important to start at the basics first. There are more specialized ways to boost or raise your credit score quickly but only when your credit foundation is strong to start.

1 | Remove Errors on Your Credit Reports

The first step in repairing credit is to start with only your accurate information on your credit reports. According to the Federal Trade Commission, 1 in 5 individuals have at least one error on their credit reports.

While that statistic is astounding it is the truth for so many with credit score challenges. And the most important thing to do is not ignore the errors and file proper disputes with all three credit bureaus.

This is not the most fun part of the process and it will take a minimum of 30 days but likely longer. Click here to get my full step-by-step process on filing credit disputes.

2 | Evaluate & Diversify Your Mix of Credit Accounts

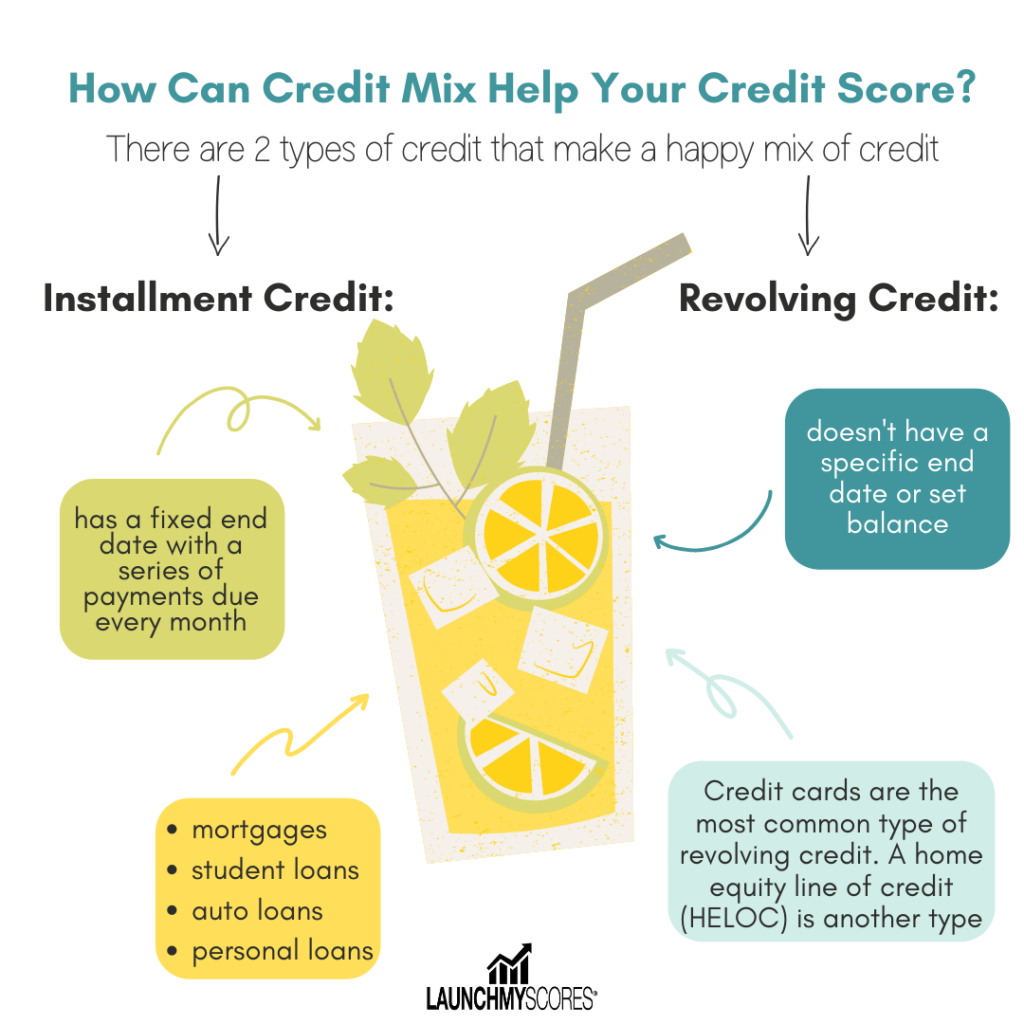

Since 10% of your credit score is calculated by your mix of credit types. This means the credit bureaus don’t like to see an individual with all credit cards or all installment loans, for example.

There should be a good mix between revolving credit types and installment credit.

Installment credit has a fixed end date with a series of payments due every month. These would be mortgages, personal loans, student loans, and auto loans. Credit bureaus love to see a mix of these, for example, a car loan and a student loan. Of course, these must be paid on-time every month in order to make a positive impact on your credit.

Revolving credit doesn’t have a specific end date or a set balance. And the most common type of revolving credit is credit cards. A home equity line of credit (HELOC) is another type common type.

If you see that your mix of credit types is unbalanced, consider applying for a credit type that you don’t have if it’s appropriate. Or if you noticed you have too many credit cards, you may want to consolidate or pay off some of your newest cards.

I say newest cards because age matters when it comes to your credit history. If you have a long standing credit card with a high available credit, it wouldn’t be recommended to close it.

3 | Bring Down Your Utilization Rate

Your credit utilization is how much credit you have available versus how much credit you are currently using. How much you owe compared with your credit limits – your credit utilization ratio – accounts for 30% of your FICO score. That means if you rack up a big balance or max out your cards, you could hurt your score.

Below is an example of how a credit utilization ratio is calculated. Say a borrower has three credit cards with different revolving credit limits.

- Card 1: Credit line $5,000, balance $1,000

- Card 2: Credit line $10,000, balance $2,500

- Card 3: Credit line $8,000, balance $4,000

The total revolving credit across all three cards is $5,000 + $10,000 + $8,000 = $23,000. The total credit used is $1,000 + $2,500 + $4,000 = $7,500. Therefore, the credit utilization ratio is $7,500 divided by $23,000, or 32.6%.

It is highly recommended to have your overall utilization rate under 30% at minimum.

4 | Become an Authorized User

There are companies that sell trade-lines. Basically, they would add you as an authorized user to an old established credit card, something like a 15-year-old credit card with perfect payment history, a high credit limit ($20,000+), and very low credit utilization.

Getting an account like that on your credit report can have a tremendous impact on your credit scores but, it typically takes 30-60 days to get the creditor to report the account on your credit file and the increase is temporary since the account will eventually be removed from your reports.

You can also see if a family member or close friend would be willing to add you as an authorized user.

It’s helpful to remember that repairing and building credit take time and diligence. This is not a quick fix. And you must learn to stay on top of your credit by keeping balances low and maintaining all the tips mentioned here in this post.

It is very possible to keep your credit in good standing over time. Just don’t give up!