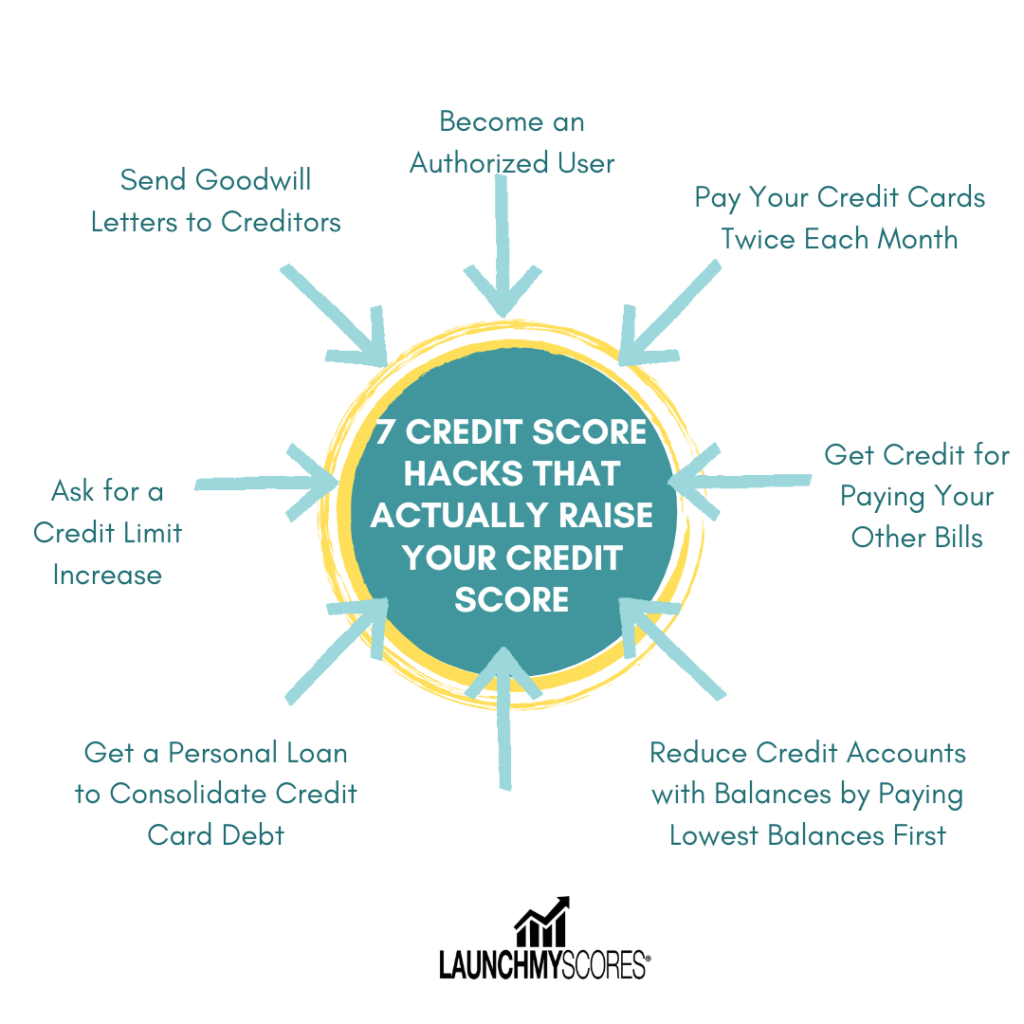

When building good credit, time is the main ingredient in the process. And there are few things that can magically raise your credit score overnight. So using the word “hacks” can seem like a misnomer because it alludes to something you can do quickly.

However, think of these credit score hacks as pro credit tips or maybe even a few secrets that you haven’t heard that you can apply to your own healthy credit habits.

First a few things on your mindset as it relates to credit scores. They’re important, and you should aim to have a good one, but you shouldn’t obsess over the numbers.

Fluctuations are a part of the process, but keeping tabs on your score will help you make good financial decisions. Watching your score could even help you spot identity theft because an unexpected score drop could indicate someone is misusing your information.

So, in short, monitor your credit scores regularly but do not allow it to become an obsession. I mean, you’ve got a life to enjoy!

Credit Score Hack #1 – Become an Authorized User

What is an authorized user? It means that you ask a primary cardholder, like a family member or significant other, if you can get approved as an authorized user on their credit card.

This works great if you have no credit or can’t get a credit card on your own. Keep in mind that some scoring systems may give less weight to authorized user accounts than they do to primary accounts, but you would still stand to benefit from them.

Be sure that you only attempt this with someone you trust and who has an excellent credit rating with a hopefully aged account and a low utilization rate.

Credit Score Hack #2 – Reduce Credit Accounts with Balances by Paying Lowest Balances First

One of the factors that are considered within the overall “credit utilization” category is the number of accounts that have balances. Having fewer accounts with balances is better for your score.

In fact, the ideal credit utilization scenario is having a zero balance on all but one of your accounts and having one account with a utilization ratio in the 1-3% range.

Therefore, if you can pay some of your accounts down to zero, you should see a boost to your score. Accounts with small balances are low-hanging fruit because you don’t have to spend as much money to get them to a zero balance.

Related: The Simple Strategy to Get Out of Credit Card Debt

Credit Score Hack #3 – Pay Your Credit Cards Twice Each Month

Yes, you read that right. When you make multiple payments in a month, you reduce the amount of credit you’re using compared with your credit limits — a favorable factor in scores. You can lessen the damage by making two payments each month: one just before the card’s statement closing date and another just before the due date.

The first payment typically reduces the balance that’s reported to the credit bureaus, while the second assures that you don’t wind up paying interest or incurring a late fee on any remaining charges.

Credit Score Hack #4 – Send Goodwill Letters to Creditors

A goodwill letter is a letter to the creditor asking for the removal of negative marks from your report. They are most effective under extenuating circumstances (a one-time mistake, a sudden loss of income, etc.).

You should definitely write your creditor a goodwill letter if a technical issue delayed your payment, such as an auto-payment that failed because you changed banks.

Be sure to mail your letter and never attempt to make the request over the phone or online contact form. In your letter, explain the situation and ask directly for the removal of the negative mark.

Keep the letter short and to the point, but also polite. Own up to the mistake if it was yours. Don’t forget to include your account number and the date of the late payment in the first sentence of your letter.

Credit Score Hack #5 – Ask for a Credit Limit Increase

By increasing the limit on a credit card, you will automatically improve your credit utilization. For example, if you have a credit card with a limit of $500 and your balance is $250, your credit utilization is 50%.

However, if you increase the limit to $1000, the credit utilization goes down to 25%.

One thing to keep in mind when requesting a credit limit increase is that it will result in a hard inquiry on your credit report, which might result in a small ding on your credit score. It’s generally not a big deal.

Credit Score Hack #6 – Get Credit for Paying Your Other Bills

There are a couple of different ways you can start getting credit for non “credit” activities.

Experian Boost is a service that will collect data on your utility and cell phone payments to help improve your payment history.

UltraFICO is another service that uses your checking and savings account balances to boost your FICO score.

Both of these will require you to give them access to your checking account so if privacy is a concern, they may not be the best option.

Related: The Smart Way to Use Your Credit Cards

Credit Score Hack #7 – Get a Personal Loan to Consolidate Credit Card Debt

There are two main types of credit – revolving and installment. One important principle to know is that installment loans are generally regarded more favorably in the FICO formula than revolving debts such as credit cards.

Therefore, by getting an installment loan (personal loan) to consolidate your credit card debt, you can significantly boost your score. Not only that, but there’s a good chance you’ll find a personal loan with a significantly lower interest rate than you’re paying on credit cards, plus the rate will be fixed over the term of the loan.

And you are lowering your credit card debt at the same time, so that’s a double win.

It’s important to note that while these credit hacks are real and effective in boosting your credit score. They are not a replacement for good credit habits and making wise financial choices. But when you need a boost, these tips are sure to get the job done.