Buying a house is a major accomplishment and something to be celebrated, however, there’s usually at least one major roadblock standing in the way of so many would-be homeowners – bad credit.

If you have bad credit or little to no credit, buying a home is going to pose a real challenge. But as a real estate broker in the business for almost 2 decades, I can assure you it’s not impossible.

In fact, it was my love of helping first-time buyers become homeowners that I got into the credit business. There were simply too many people wanting to buy homes that couldn’t because of credit and I wanted to do something about that.

If you don’t have a stellar credit rating and want to know how to buy a house, stick with me and follow these steps and if you give it the time it needs – you’ll see the difference in your credit score.

Related: How to Save for a House on a Lower Income

Get To Know Your Credit First

If you haven’t already, you need to pull your own credit reports to know exactly what your credit situation is. There are many different scenarios and every credit profile is as unique as a fingerprint.

Your credit report will work as a blueprint, letting you know what needs to be corrected, paid, or something else altogether.

Keep in mind that you’re entitled to pull your credit report from each of the three major credit bureaus for free once per year. Use them! You can get your free credit reports at Free Score 360 which is a trusted site we use for our credit clients.

What Makes Up My Credit Score?

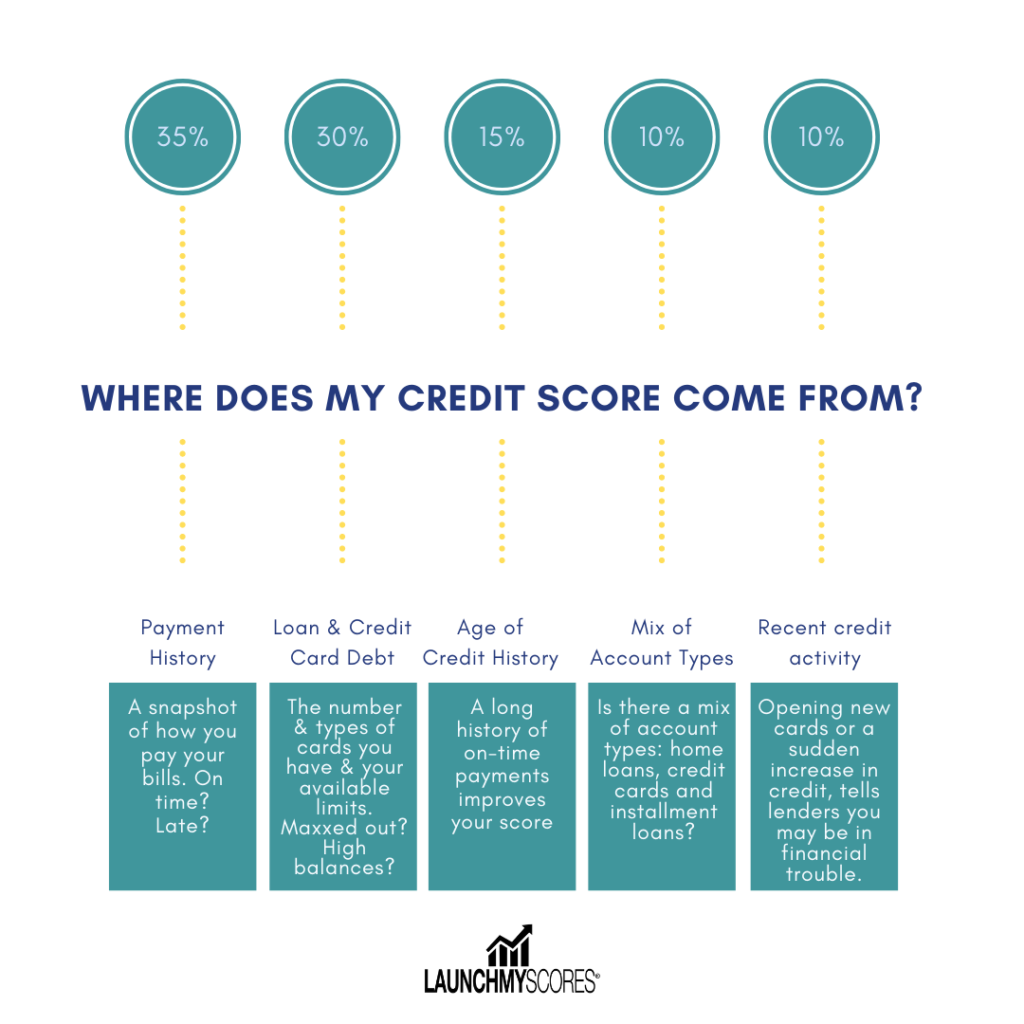

Your credit score matters because it is the single factor lenders use to determine if you are trustworthy to lend their money to. So it’s something that may feel like a total mystery but below is a breakdown of how your credit score is calculated to make things a little less mysterious.

- Payment history: 35% of your score

- What goes into it: This portion of your credit score reflects—you guessed it—your payment history. If you pay your debts on time each month and cover at least the minimum payment amount, this portion of your score should be in relatively good shape.

- Loan & Credit Card Debt: 30% of your score

- What goes into it: This factor is called your utilization ratio and it’s basically how much credit you’re currently using versus how much you have available. For the most part, the less credit you’re currently utilizing, the better your credit score. For example, say your credit card has a maximum balance of $10,000. If your balance is relatively low, say $1,000, this will reflect better on your credit score than if you were using up $8,000 of your maximum credit.

- Length of credit history: 15% of your score

- What goes into it: Creditors want to see that you have a solid long-term history of paying off debt. Think about it: a lender can’t tell very much about whether you’ll pay your mortgage on time from looking at 3 months of data. So the longer your history with credit, the better.

- Mix of Account Types: 10% of your score

- What goes into it: Interestingly, having different types of debt is considered a good thing by the credit bureaus. It shows that you can handle different types of loans (car loans, student loans, credit cards, etc.), and that you’ll pay them back according to the terms of your contracts.

- New Credit Activity: 10% of your score

- What goes into it: Opening a new line of credit can negatively impact your score for a while. That’s why you should avoid taking out any new loans in the months leading up to your mortgage. Remember — the credit bureaus reward you for longer-term credit. Be very careful about adding any new debt while you’re home shopping.

Related: The Simple Way to Get Out of Credit Card Debt

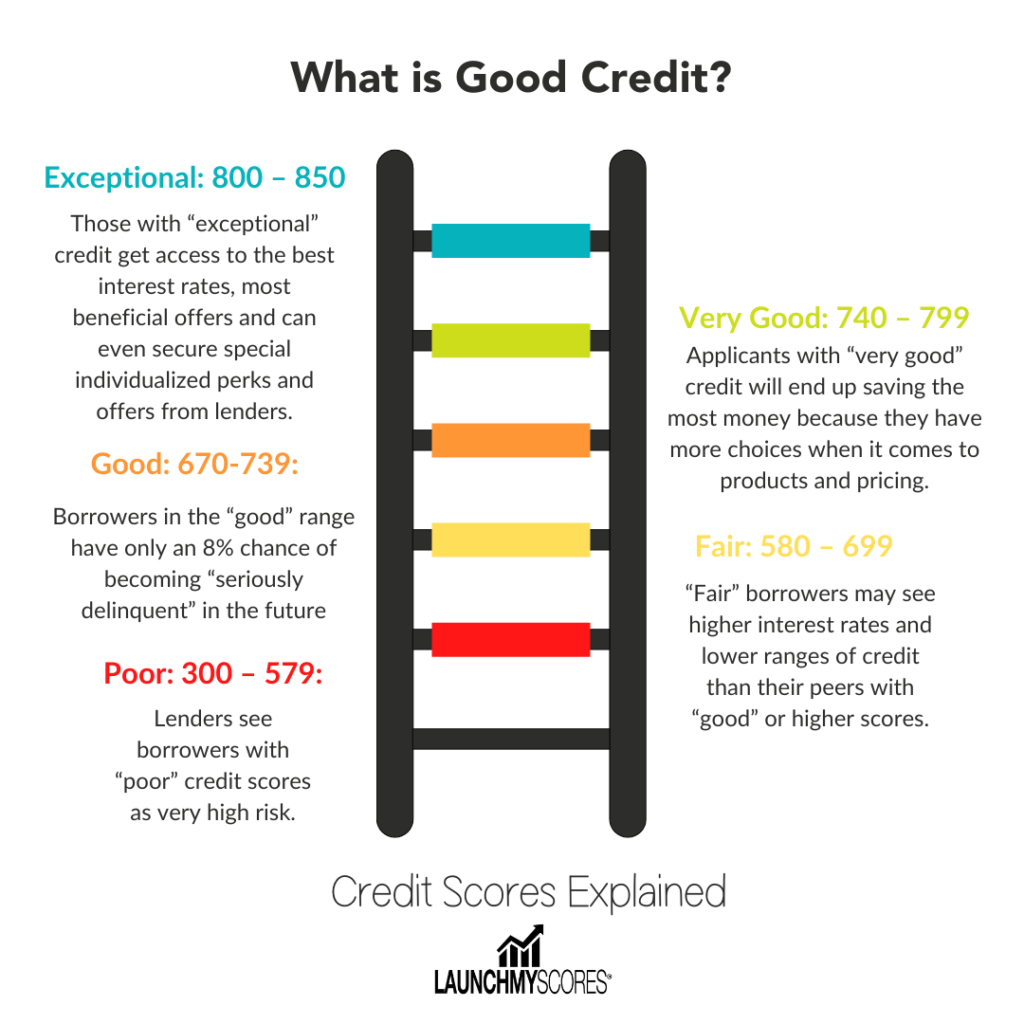

What is a Good Credit Score Range?

Now that you have your credit reports and understand how those score are being calculated, now you’re probably wondering what scores are considered good, bad, or excellent.

Here’s a quick graphic to break this down simply:

The Minimum Scores for Various Mortgage Types

There are minimum credit score requirements for each mortgage loan type and we’ll show those in the chart below. However, it’s important to note that your credit score is not the only factor in getting a mortgage approval.

Mortgage approval takes into account your credit score, current employment, overall income, debt to income ratio, and your ability to pay your required closing costs and down payment.

| FHA Loan | 580 | A loan insured by the Federal Housing Commission, popular for home buyers with poor credit or little savings |

| FHA 203K Loan | 620 | A loan to finance the cost of renovation in addition to the purchase cost |

| Conventional Loan | 620 | A loan not backed by a government entity |

| VA Loan | 620 | A loan available to Veterans and partially backed by the Department of Veterans Affairs |

| USDA Loan | 640 | A loan eligible for rural and suburban home buyers |

Steps to Fix Your Credit to Prepare for a Mortgage

If you pull your credit report and find that your scores are in the range below the numbers in the above chart, you’ll need to make some changes to your credit in order to get mortgage approval.

1 | Dispute Credit Errors

Did you know that credit report errors are extremely common? According to recent government data, more than 1 in 5 Americans have material (read: pretty major) errors on their credit reports.

Once you have your credit report in hand, the 3 items we are concerned with most are:

• “Public Records”

• “Derogatory Accounts”

• “Unsatisfactory Accounts”

Public records are the worst – these include bankruptcies, tax liens, judgments, and other items of“public record” that other people can see.

Derogatory accounts are usually accounts that have been referred to a collection agency. These are the really annoying people who call you and break a lot of rules and laws in doing so.

They have purchased your debt from the original creditor for somewhere around 30-50 cents on the dollar, so they will try to recoup those funds, and then they’ll disappear. That’s why it’s vital to not talk or make any arrangements with collection agencies over the phone – EVER.

Unsatisfactory accounts are accounts that have “late pays”, where you are (or were) 30-90 days late on a payment but have not yet been referred to a collection agency.

The actual dispute process is a lengthy and detailed process that most individuals prefer not to deal with themselves. If you would like to know the full process of correcting errors on your credit report read here. Yes, you can do it – it just takes a lot of work.

If you prefer to get some help and the experience to go with it, my full service credit repair agency is here to help you. I’ve been a real estate broker for almost 2 decades and also have a full service credit repair agency ARG Financial Services to help those who need to improve their credit to purchase a home.

2 | Watch Your Credit Utilization Closely

Your credit utilization refers to the monthly ratio of the amount of credit you have available versus what you actually use, and it makes up 30 percent of your credit score as noted in the graphic above.

It is recommended that you keep your credit utilization at 30% or less – preferably closer to 25%.

For example, if you have two credit cards with a limit of $500 each, your total available credit is $1,000 per month. Let’s say you carry a balance of $800 from one month into the next. Your credit utilization is now 80 percent—this isn’t a good sign to the banks because it makes you seem risky.

This is also not the time to open new credit lines or make large purchases. Unless you are opening new credit lines in order to build positive credit. But making large changes such as adding new accounts or closing accounts can cause big swings in your credit score.

3 | Make ALL Payments on Time

Again, this is not the time to make any payments late. Your payment history makes up the largest factor in your credit score.

Any late payments reported to the credit bureaus can cause major drops in your credit rating which will only hurt your chances of getting approved for a mortgage.

4 | Become an Authorized User

An authorized user is any person other than the primary cardholder who’s able to use credit cards on the account. For example, your parents may have given you an “emergency” credit card as a teenager. You were able to use it because they added you as an authorized user on their account.

As an authorized user, you aren’t responsible for paying the bill at the end of the month. However, you can benefit greatly from their positive credit rating. You may have a family friend or parent who has excellent credit and may add you as an authorized user.

Our credit repair agency offers this as a service to our clients.

5 | Get a Rapid Rescore

If you’ve done all the work of disputing errors and paying off accounts that your lender recommends and you’re waiting on your credit score to increase – you don’t have to wait the months this usually takes.

You can pay for a rapid rescore through your lender and have your score increased in a matter of 72 hours. Again, this is only at the end of your process to speed things up a bit for a faster mortgage approval.